Kuusamo Hirsitalot Oy / Kuusamo Log Houses continues to be financially stable and is one of the top companies in the industry in terms of economic metrics. In this news article, we present updated key figures based on the financial statements for 2023.

Kuusamo Log Houses had a positive result in 2023

Over the years, Kuusamo Log Houses’ operations have been well thought out, and the company has established itself as one of the leading companies in the industry financially. The company maintained its strong financial position in 2023, although the industry has faced many challenges. Throughout the company’s history, every financial year has been positive in terms of performance; this was also the case in 2023.

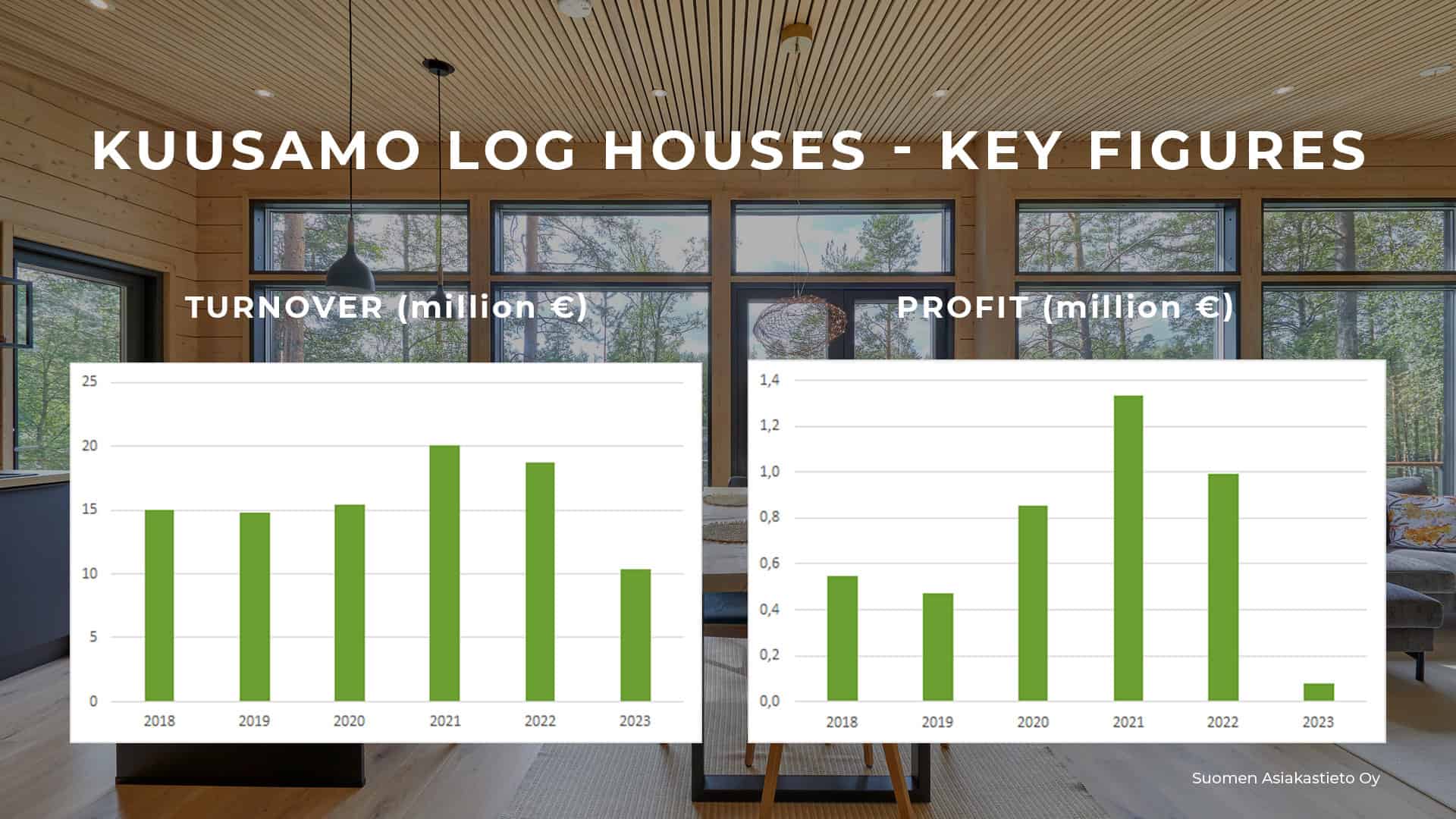

In 2023, Kuusamo Log Houses had a turnover of EUR 10.4 million and an operating profit of EUR 79,000. This result can be seen as a countermeasure victory, as it demonstrates the company’s ability to adapt and maintain its profitability in difficult market conditions.

– Despite a difficult business cycle and a sharply contracting market, we managed to maintain a positive operating profit. We reacted very quickly to the market change and started adjusting operations in a timely manner. This allowed us to keep costs under control and the operation profitable, says Arto Orjasniemi, Managing Director and shareholder at Kuusamo Log Houses.

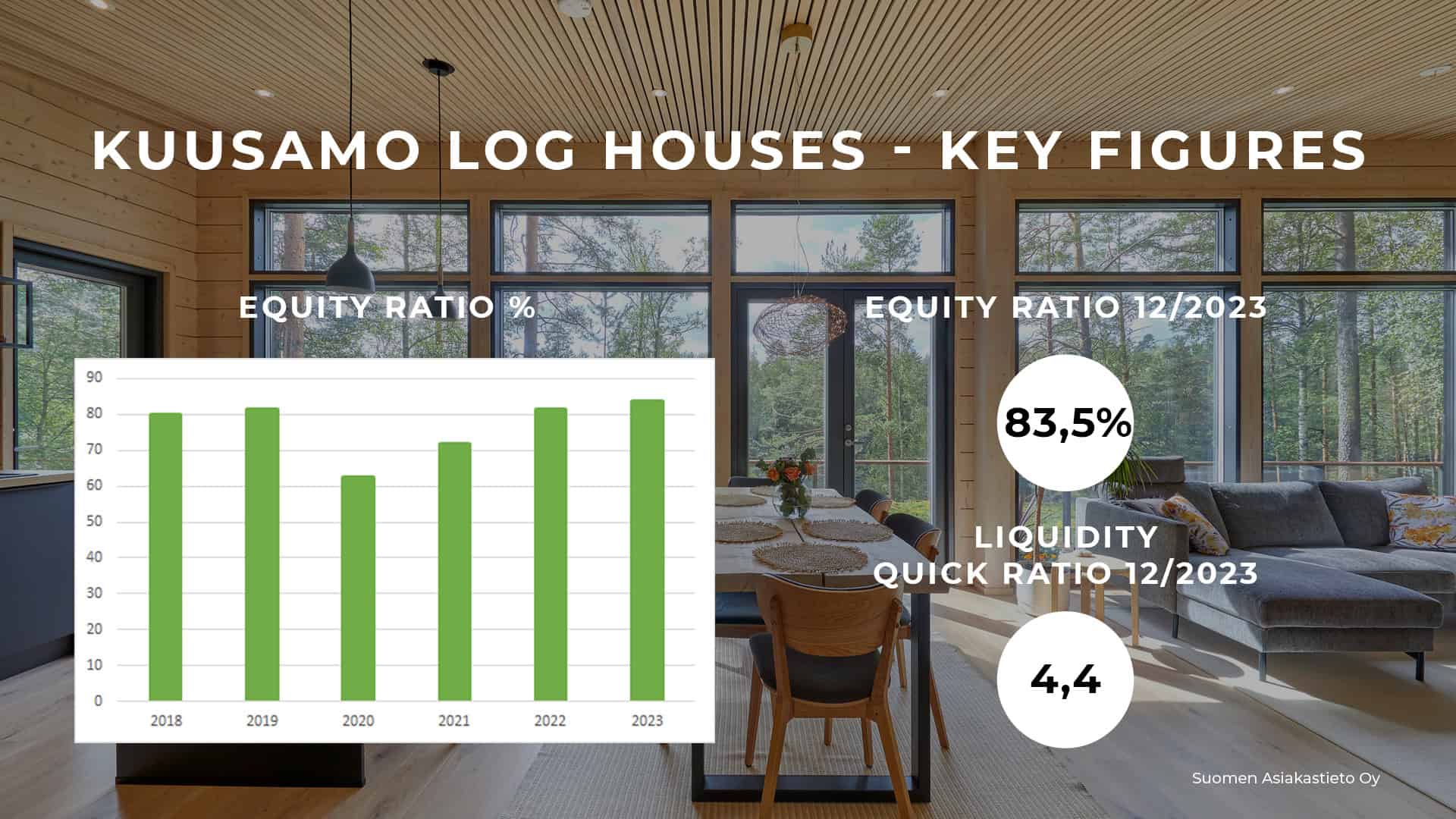

The company’s equity ratio has risen to an impressive 83.5%, which indicates excellent financial and risk management. The increase strengthens the company’s ability to cope with financial challenges and invest in the future.

Liquidity of Kuusamo Log Houses at an excellent level

According to a report by Suomen Asiakastieto Oy, Kuusamo Log Houses has excellent liquidity: The quick ratio is 4.4, and forecasted payment behaviour over the next nine months is at an excellent level. This means that the company is able to perform on its short-term debts and obligations without problems, creating a sense of security for both customers and partners.

– Thanks to the positive operating profit, our company’s solvency and, thus, liquidity remain at a very good level. This makes us a safe choice for our customers as a house supplier, comments Arto Orjasniemi.

Financial stability also enables flexibility and responsiveness to market changes and creates investment opportunities for the company’s growth and development.

Credit rating: AAA GOLD

Kuusamo Log Houses’ credit rating is AAA Gold. For more than three years, Kuusamo Log Houses has continuously held the highest AAA credit rating. Only about 0.3% of all Finnish companies will achieve this achievement in 2024.

The company’s strong financial situation also makes it possible to guarantee advance payments. Kuusamo Log Houses issues a guarantee backed by the insurance company LähiTapiola for advance payments until the time of delivery. In practice, this means that if the goods are not delivered and the contract thus goes unfulfilled, the customer can demand the advance payment back from LähiTapiola. This provides customers security in unexpected situations.

Future outlooks

The outlook for 2024 is cautiously positive. According to forecasts, the company’s turnover will increase slightly compared to the previous year. This growth shows the market’s confidence in Kuusamo Log Houses’ products and services.

– The market situation continues to be challenging, and there is no rapid and clear market change in sight, says Arto Orjasniemi. However, the development of our business operations has been positive, and we expect this year to be better than last year.

– We have noticed that our company’s stable financial situation has often played a decisive role when our customers make a purchase decision. We are grateful for this, Arto Orjasniemi continues.

In summary, Kuusamo Log Houses looks to the future with hope and confidence. The company is ready to face the challenges of the future, supported by a strong financial base and a positive outlook. It continues to invest in improving customer satisfaction and quality, laying the foundation for sustainable growth and success.

What Is Equity Ratio, Credit Rating, And Quick Ratio?

Equity ratio

Equity ratio is a measure of the solidity of a company’s finances and its ability to withstand losses and complete all commitments in the long term. The number indicates how much of the company’s assets are financed with own capital as opposed to foreign capital, i.e. loans.

According to Osuuspankki bank, an equity ratio of over 50 percent is considered excellent and an equity ratio of 30 to 50 percent is considered good.

Credit rating

A company’s equity ratio describes its ability to take care of its financial obligations, such as loan and bill payments. Credit rating will make it easier for other companies, financial institutions, suppliers, and other stakeholders to estimate the risk level of the company in its operating environment.

In order to achieve a AAA rating by Dun & Bradstreet (formerly Bisnode Finland Oy), the company’s turnover must be over 170,000 euros, its return on investment must exceed 15 percent, and its equity ratio must be in order. Debt to equity ratio and liquidity key figures will also be considered. In the AAA class, all key figures must be at the best level at the same time. If this is not achieved, but the key figures are at a good level nonetheless, the credit rating will be set at AA.

Quick ratio

Quick ratio is a financial indicator measuring the strength of a company’s ability to make short-term payments. It is a formula that gives an idea of how well a company is able to pay off its short-term obligations using quickly available liquidity, such as cash and easily realised investments. Quick ratio paints a picture of how well a company could survive if it needed to pay all of its short-term obligations at once. Quick ratio is excellent when over 1.5 and good when between 1.0 and 1.5.